Commercial Solar Panel Experts

Arizona Solar Wave is a locally owned and operated business with the knowledge and experience to work with government, non-profit, and commercial entities in Arizona. We provide innovative technical and financial solutions that facilitate the transition away from fossil fuels toward clean, renewable sources of green energy.

Arizona Solar Wave is a locally owned and operated business with the knowledge and experience to work with government, non-profit, and commercial entities in Arizona. We provide innovative technical and financial solutions that facilitate the transition away from fossil fuels toward clean, renewable sources of green energy.

With years of experience using the very best in technology, we’ve become known as the most trusted solar provider in Phoenix and beyond. We take your business very seriously and believe in creating long-lasting customer relationships. You can count on Arizona Solar Wave to help you achieve your energy independence, sustainability, and financial goals by switching to solar.

Tax credits and incentives make it possible for more businesses to take advantage of the benefits of solar.

MACRS Accelerated Depreciation

MACRS Accelerated Depreciation

Year 1 Bonus Depreciation

Year 1 Bonus Depreciation

30% Federal Tax Credit

30% Federal Tax Credit

Even More Solar Incentives

Even More Solar Incentives

I am a local business owner who relocated to Arizona from Ohio in 2012. I could not believe the number of days with crystal clear skies compared to Ohio. I did my due diligence selecting a solar company. When I met Brad, from Arizona Solar Wave, I knew they were the company I could trust. I have worked with many contractors before who fail to follow through on their promises, Arizona Solar Wave is not one of them! They went above and beyond my high expectations.

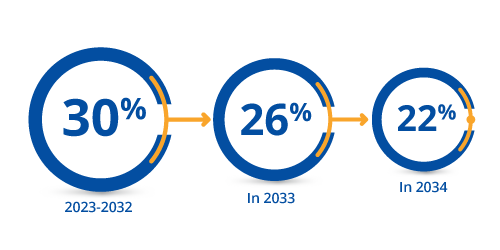

As if lower utility bills were not enough, when you switch to solar, customers are able to take advantage of tax benefits that significantly reduce the cost of the system. There is a 30% federal tax credit that is still available, and commercial solar customers are able to depreciate their solar systems on their federal and state taxes. These tax incentives are equivalent to 60–70% of the cost of the system, and between the solar savings and tax incentives, customers can get their money back in anywhere from 4 to 6 years. With a 30-year or more useful life, once your solar system has paid for itself, it will keep saving money for decades to come.

As if lower utility bills were not enough, when you switch to solar, customers are able to take advantage of tax benefits that significantly reduce the cost of the system. There is a 30% federal tax credit that is still available, and commercial solar customers are able to depreciate their solar systems on their federal and state taxes. These tax incentives are equivalent to 60–70% of the cost of the system, and between the solar savings and tax incentives, customers can get their money back in anywhere from 4 to 6 years. With a 30-year or more useful life, once your solar system has paid for itself, it will keep saving money for decades to come.

Financial Incentives

This aspect is perhaps the most well-known. The Federal Solar Investment Tax Credit (ITC) and the 5-Year Modified Accelerated Cost Recovery System (MACRS) have been important drivers in reducing costs for companies going solar. Many other rebates and incentives exist at the state, municipal, and utility levels. You can find out more about specific locations by searching the Database of State Incentives for Renewables & Energy.

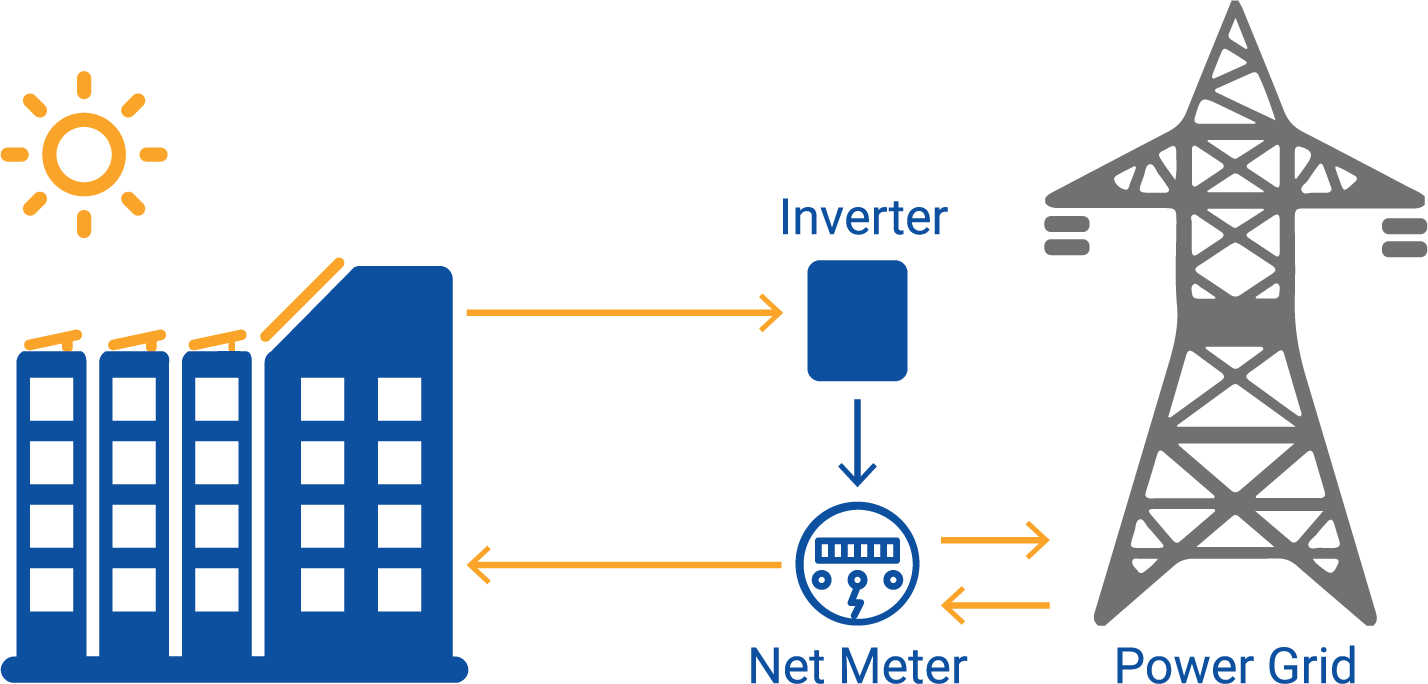

Strategic Net Metering

Utility customers with net-metered photovoltaic systems are credited for each kilowatt produced by their system, and each month will be billed for the number of kilowatt hours they used minus the number of kilowatt hours generated. When generation exceeds usage for a given month, a credit for each excess kilowatt hour will be issued, to be applied in later months when the system generates less electricity than consumed. Credit for excess generation will roll over from month to month indefinitely.

Rate Structure Incentives

While most companies have heard of net metering, perhaps one of the least talked about, but extremely important topics, is the role of rate structures. When possible, having the ability to rate switch to the best utility rate structure is extremely helpful in creating a winning financial scenario.

Maximizing Financial Value

This is a time of great opportunity to go solar. The right partner, like Arizona Solar Wave, can help you assemble the most financially advantageous combination of incentives, rate structures, financing, and investors (when applicable) to help your business achieve the maximum benefits and value from your solar project.