Utility and Tax Incentives

Governments at every level—federal, state, and local—understand how important clean energy is and how costly traditional power can be. As homes use more electricity, utility companies find the costs of their infrastructure increasing. That’s why, in most cases, people can save a lot through utility and tax incentives, often more than 50% on their energy bills.*

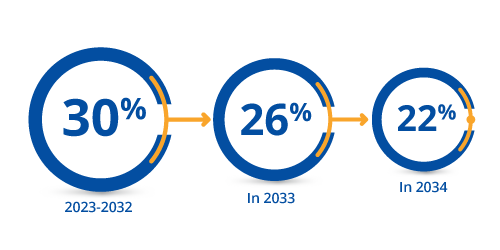

Federal Investment Tax Credit – 30%

The Solar Investment Tax Credit (ITC) offers a direct reduction in the income taxes that a homeowner would have to pay to the federal government. If you install a solar system from now until 2032, the ITC gives you a credit worth 30% of the installation cost. However, this tax credit doesn’t apply to leased systems. Act fast, as prices for solar equipment are increasing!

Arizona Incentives

The Residential Arizona Solar Tax Credit gives homeowners a 25% reimbursement on the cost of solar panels, up to a maximum of $1,000, which can be deducted directly from personal income tax in the year the system is installed. If the credit is more than what you owe in taxes in the installation year, you can carry forward the unused portion for up to five years. Plus, you might be eligible for additional incentives specific to your utility company. Don’t stress; your energy consultant will ensure you take advantage of all available benefits.

Increase Home Value

Installing a residential solar energy system is a capital improvement that increases your property’s value. Homes with solar often sell quicker and for more money than those without. Additionally, your investment in solar power raises your home’s tax basis. When you sell your home, you can deduct this tax-based investment from the sale price, lowering the portion considered as profit. This reduction can decrease the taxes on the sale and might even help you avoid capital gains taxes on the property’s appreciation.

*Ask your representative about which incentive you’re eligible to receive. Please consult a tax advisor on your ability to claim these nonrefundable tax credits.